A lot of people don’t understand the consumer credit system. And many more don’t understand the business credit system. Today I’ll cover some common business credit myths and explain what can be learned from them.

Myth #1: Business Credit is Just Like Personal Credit This sounds like it ought to be true, but it isn’t.

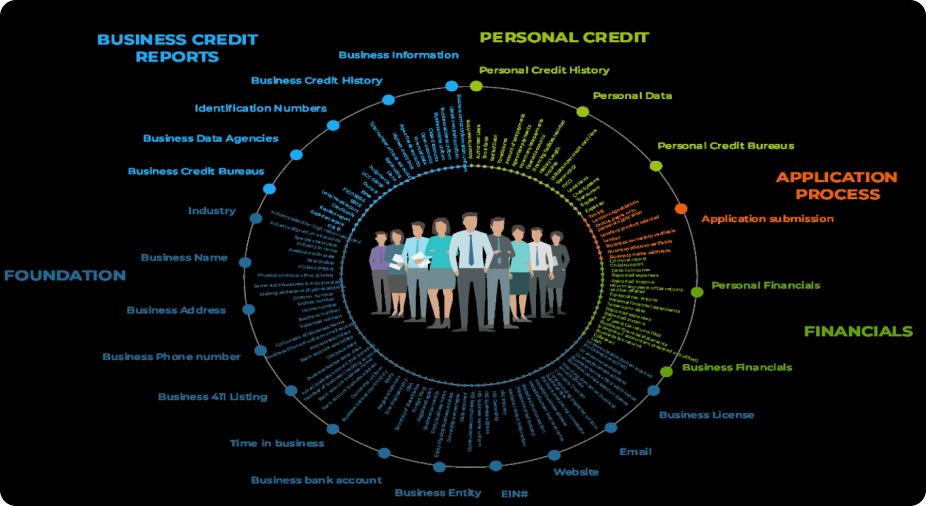

Sure, the credit systems are similar. But there are some major differences that can seriously affect your business. For starters, the consumer credit system has, both in court and in congressional testimony, been shown that it can anti-consumer. The system works against consumers often. It is prone to errors and tends to resist the correction of

any errors by consumers or their advocates. In one example, even after a credit bureau lost in court, they continued to refuse for months to remove incorrect information from the person’s credit reports. The business credit system is different. It is not anti-business (or anti-consumer) and is less prone to errors. And when there are legitimate errors, it tends to be easier to correct them.

Myth #2: It Doesn’t Hurt to Use Personal Credit in Place of Business Credit This is a problematic way of thinking that can lead to big problems down the

road. Using personal credit for business purposes puts your personal credit at

risk for the sake of your business. By doing so, you limit the resources available to you personally and to your business. The end result could be disastrous. Imagine when your business credit needs exceed your personal credit capacity. And then you need to use your personal credit and can’t because it’s tied up by your business. No matter how you spin it, in the end using your personal credit for business is a bad idea.

Myth #3: Business Credit and Personal Credit Are Not Related

Using your personal credit for business use is a bad idea. But we can’t 100% separate business credit and personal credit. Often, especially when starting out with business credit, a company owner must provide a personal guarantee for the business credit loan or line of credit. When providing a personal guarantee, the company extending credit will not only check your business credit. They will check your personal credit history. While the business account won’t show up on your personal credit report, the personal guarantee could eventually affect your personal credit if the business fails to meet its obligations. Aim to avoid that scenario (and you can) with careful planning and smart use of business credit.

About the Author

Mark the President of Commercial Credit Access (“MyCCA”).

Mr. Sheehan spent the last 22+ years working in the equipment finance business helping SMB’s obtain financing to grow their business. He has worked in a variety of positions for banks and independent finance companies. Mark brings a unique wealth of credit and lending knowledge to help his customers improve their business credit and obtain financing.

Mr. Sheehan is the driving force behind the release of Commercial Credit Access powered by Fundability (“MyCCA Fundability”). MyCCA Fundability is the leading business cash and credit access system in the world today.